Iran’s Risks and Rewards: Could You Be a Successful First-Mover?

If you are in politics or business, in the Middle East or beyond, you probably have an opinion about the recent nuclear deal between Iran and the P5+1 and how it is all going to play out. You have probably heard people loudly question how crucial the agreement is, and have likely heard them disagree – ferociously at times – on its consequences for politics and security the Middle East.

When it comes to the business implications, though, the debate falls quiet.

Businesspeople of all stripes describe Iran to me as “our game-changer,” “the wild card” and “a strategic priority.” It would not be an overstatement to say that Iran’s potential re-opening compares to the collapse of the Soviet Union and the emergence of Myanmar (Burma). That said, a series of factors, including demographics, resource base and geography - not to mention diplomacy - make this opening feel a bit different.

Risk is never too far from any conversation about Iran; a justifiable dose of caution permeates many executives’ decisions about how and when to approach the Iranian market. The reasons are several: the experience of banks (particularly European) over the past few years at the hands of regulators (mainly American), all under the close watch of regulators and lobbyists. Round out the list with generous helpings of political risk, legal complexities and corruption concerns, and you can see why amid all of the enthusiasm, not everyone is rushing headlong into market entry just yet.

I thought of the two Irans—one of massive commercial opportunity and the other of massive business risk—while reading a recent article in the Harvard Business Review entitled "How to Live With Risks." The article reported on a study by Matt Shinkman of CEB, an organization with 10,000 member companies.

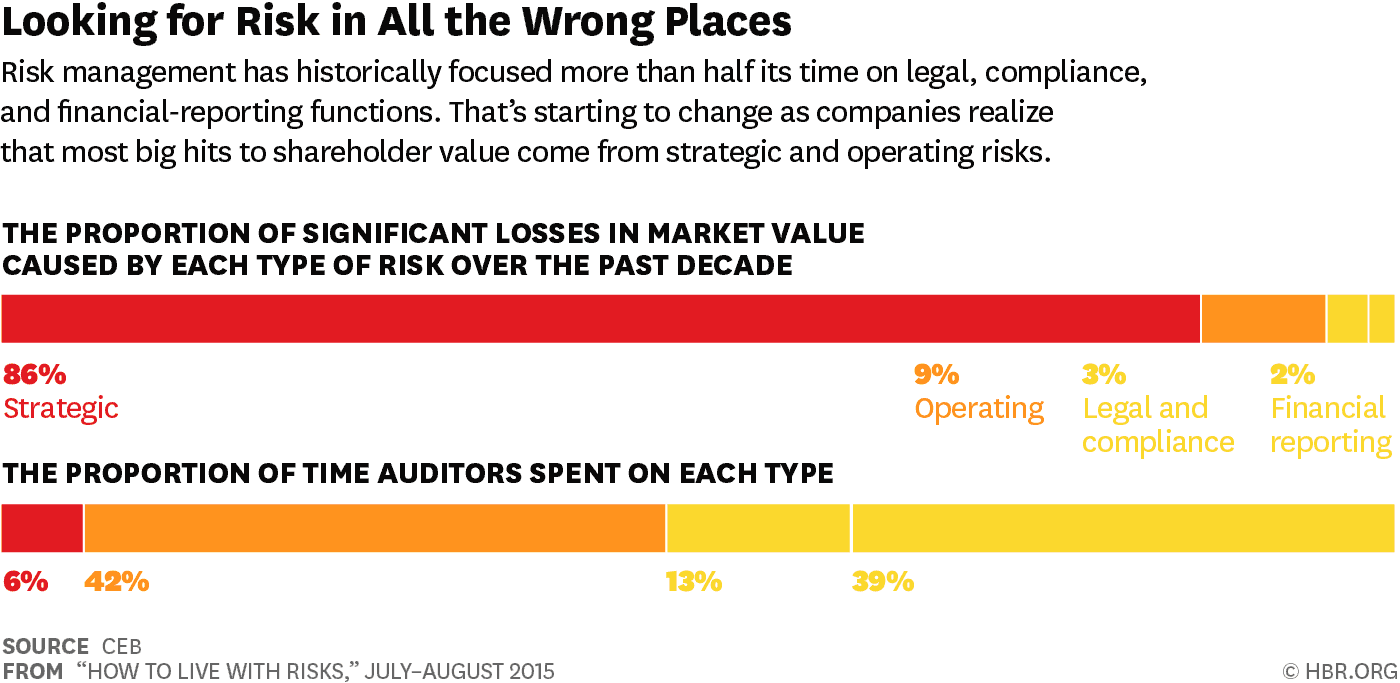

Executives cited in the study said risk managers and auditors prioritized value protection—financial reporting, legal controls and compliance concerns—when seeking to minimize potential threats. In other words, risk management was aimed solely at risk prevention—an exercise in trying to stop bad things from happening.

The article’s research went on, however, to show that mishandling strategic risks—rather than botching tactical risk prevention—does more damage to the long-term value of a company. While 86% of lost market value was attributable to a mishandling of strategic risk, auditors only spend 6% of their time addressing strategic issues.

The lesson is clear. While the risk managers' role is to protect value, they can and should also create value for their companies through pro-active opportunity risk management. They can help to seize opportunities by managing strategic risks and turning them into genuine value for companies, their employees and their stakeholders.

Iran presents most companies with risks that would qualify as strategic. Why else would we be calling Iran “our game-changer,” “the wild card” and “a strategic priority?” Getting Iran wrong sounds like more than just a missed chance.

So it is fair to assume that risk management teams are going to be involved in any well-considered decision about how and when to do business in Iran. The question is: How and when will these teams be involved in your market entry strategy? Will risk managers be asked to look for bush fires, or will they be charged with scanning the horizon for the full complement of challenges and opportunities? If risk management helps build an Iran strategy from the outset, then both internal and external stakeholders can be assured that not only have preventive measure been taken, but that broader issues are under control as well.

Consider a company that has been searching for – and has finally found – a business partner in Iran. The partner meets all the commercial criteria; the terms and conditions have been served up for signature. But wait: has anyone checked whether this partner meets the company's risk, compliance and ethical standards? Fire-fighting risk management is brought in at the last moment. What happens if the partner falls short? Time and money have both been thrown away; an awkward conversation with an eager Iranian partner awaits. Oh, and will there be a chance to start again?

We see this all the time – new opportunities are vetted far too late in the decision-making process and surface uncomfortable concerns that destroy entire strategies.

Proactive risk management prevents this from happening. If business development and risk management work together on partner selection and due diligence, for example, companies create internal alignment on issues of risk. The company’s strategy – and reputation – is under better stewardship, internal resources are not wasted, and deals proceed more smoothly.

In other words, don’t vet mature opportunities, when it’s already too late. Vet your entire pipeline of opportunities at a level sensible to their stage of development.

There’s more. Can an understanding of the day-to-day risks to doing business influence whom you hire in a new market and how you train them? Can monitoring changes in a government’s foreign policy and international relations allow you to anticipate moves like deregulation, and move faster than your competitors? This is where risk management turns into opportunity enhancer. And this is what will make first movers successful.

Today, it’s Iran. Yesterday it was somewhere else, and so it will be tomorrow. The principles of risk management remain the same no matter what the market. But Iran is not just any new market, and there aren’t that many Irans left, which makes the stakes feel that much higher.

Photo Credit: Scania Oghab Afshan